A. Purchase Tax Invoice

- Log in to OnlinePajak and click the Start button in the eFaktur column.

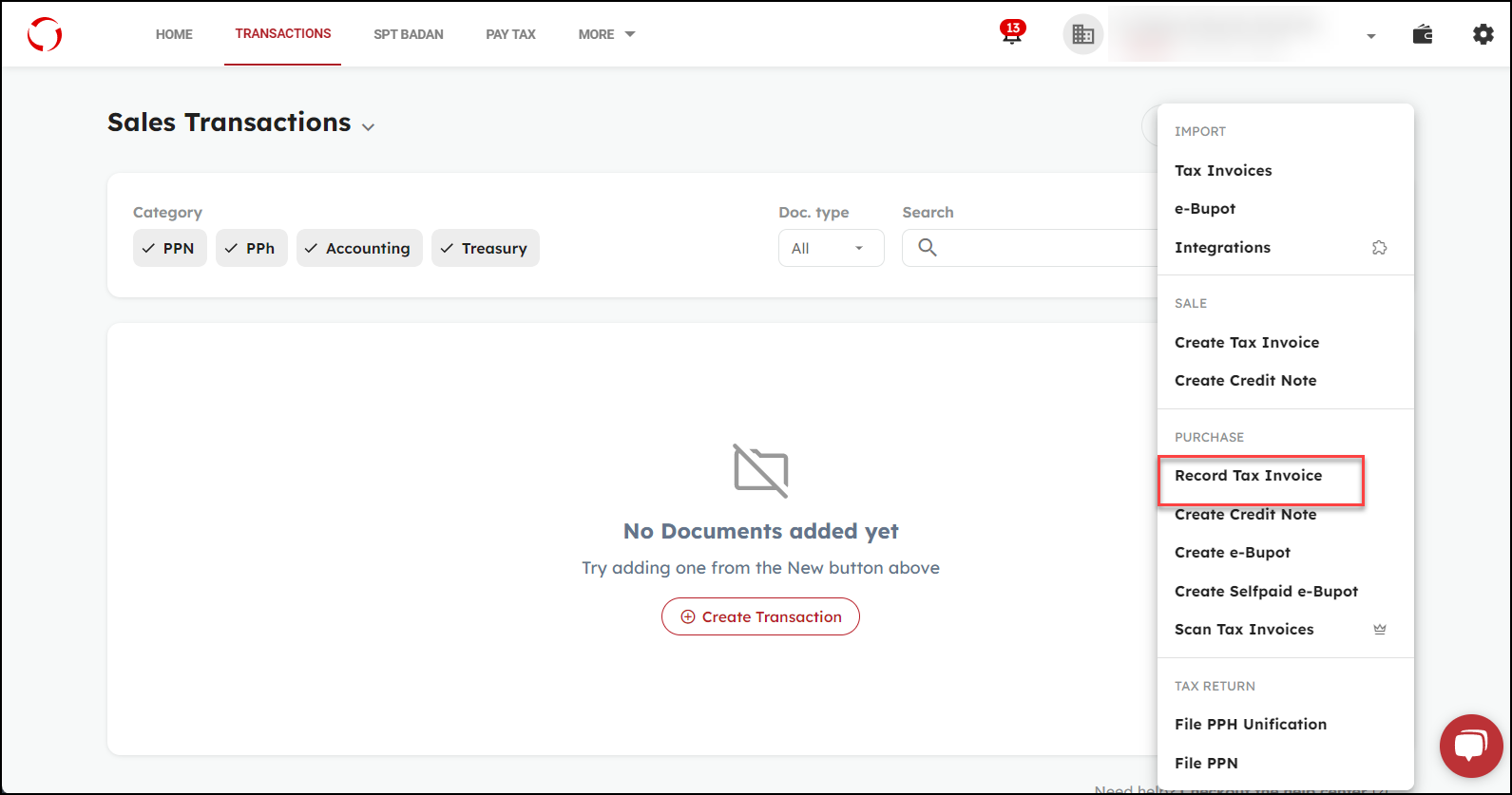

- Click the New button and select the Record Tax Invoice menu.

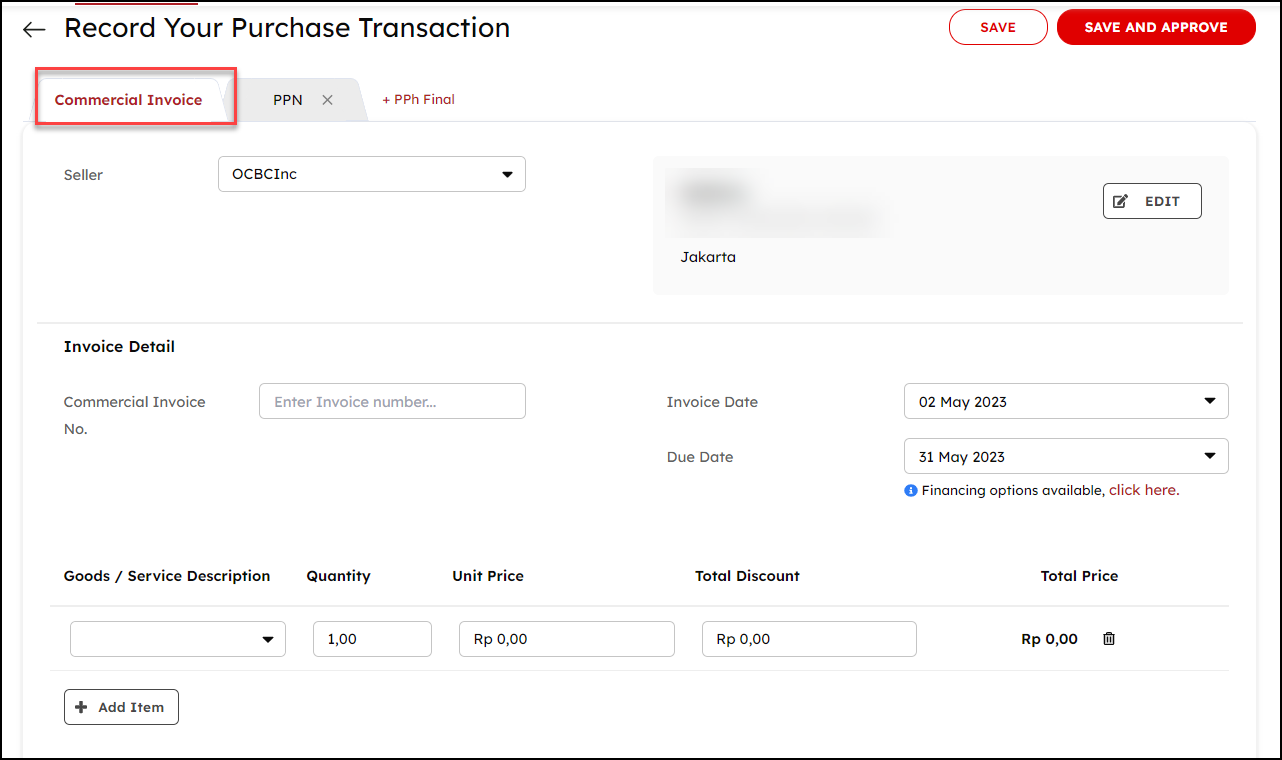

- On the Commercial Invoice tab, complete the seller’s name, Invoice number, Invoice date, Due date, etc.

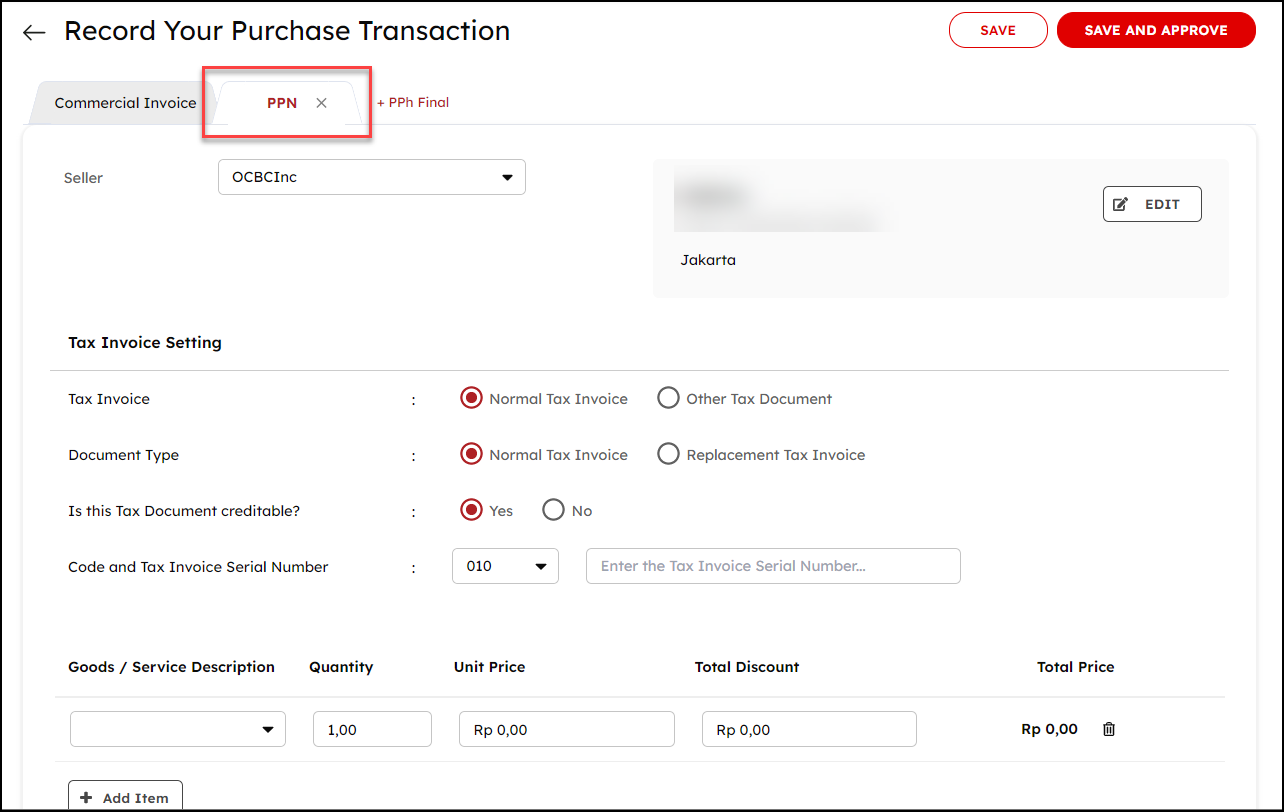

- On the VAT tab, enter the Tax Invoice Serial Number (NSFP), and then adjust the VAT amount according to the value stated in your transaction. Also, choose the appropriate document type, either Normal Tax Invoice or Replacement Tax Invoice. Then, Save and Approve the draft.

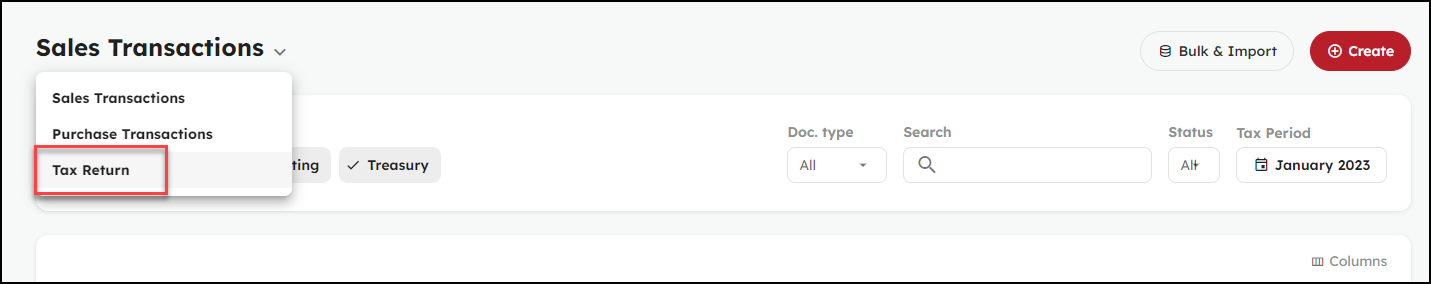

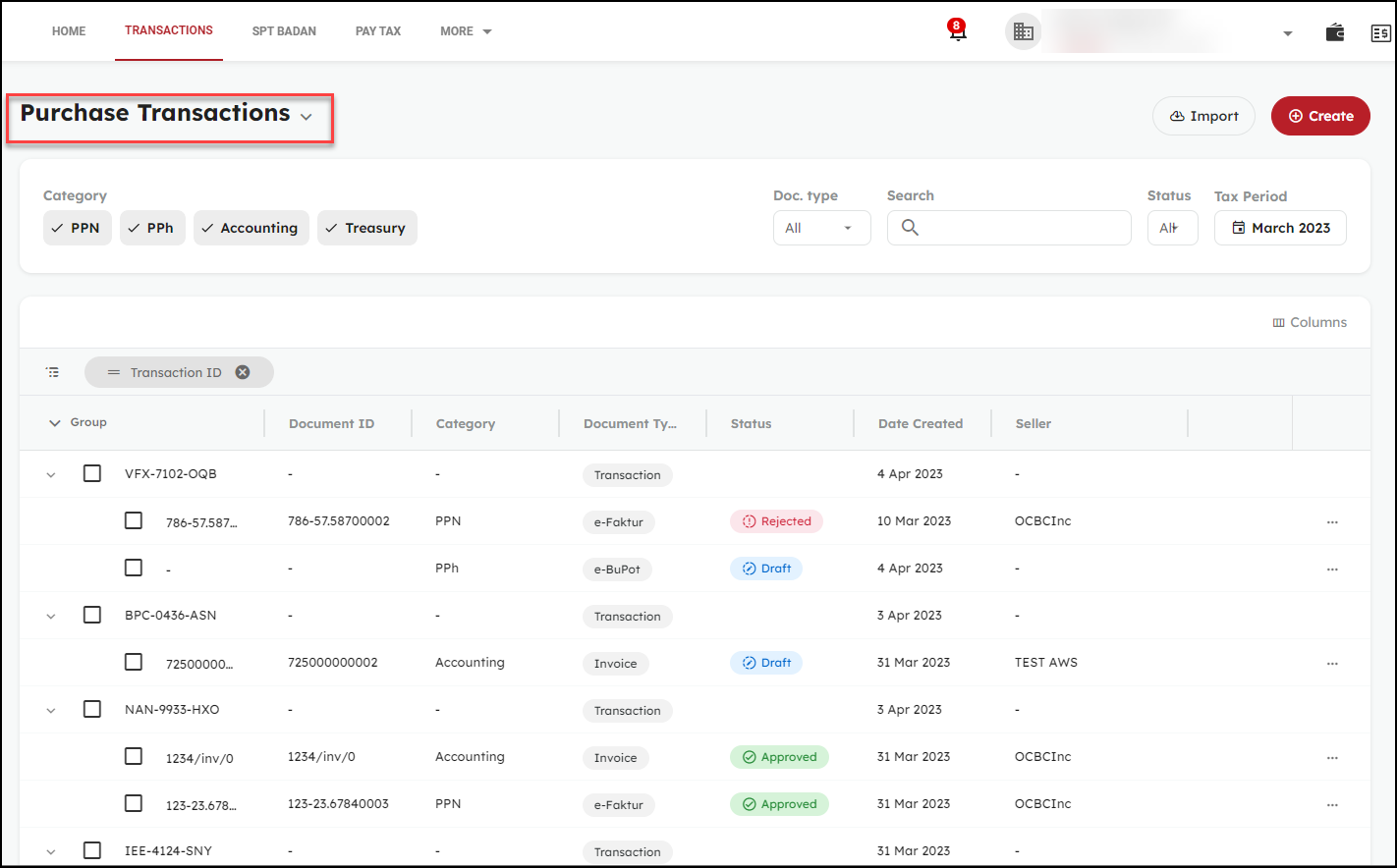

- To view all the Purchase Tax Invoices, select the Purchase Transactions menu.

B. Sales Tax Invoice

Creating a Sales Tax Invoice on OnlinePajak is very easy. Here are the steps:

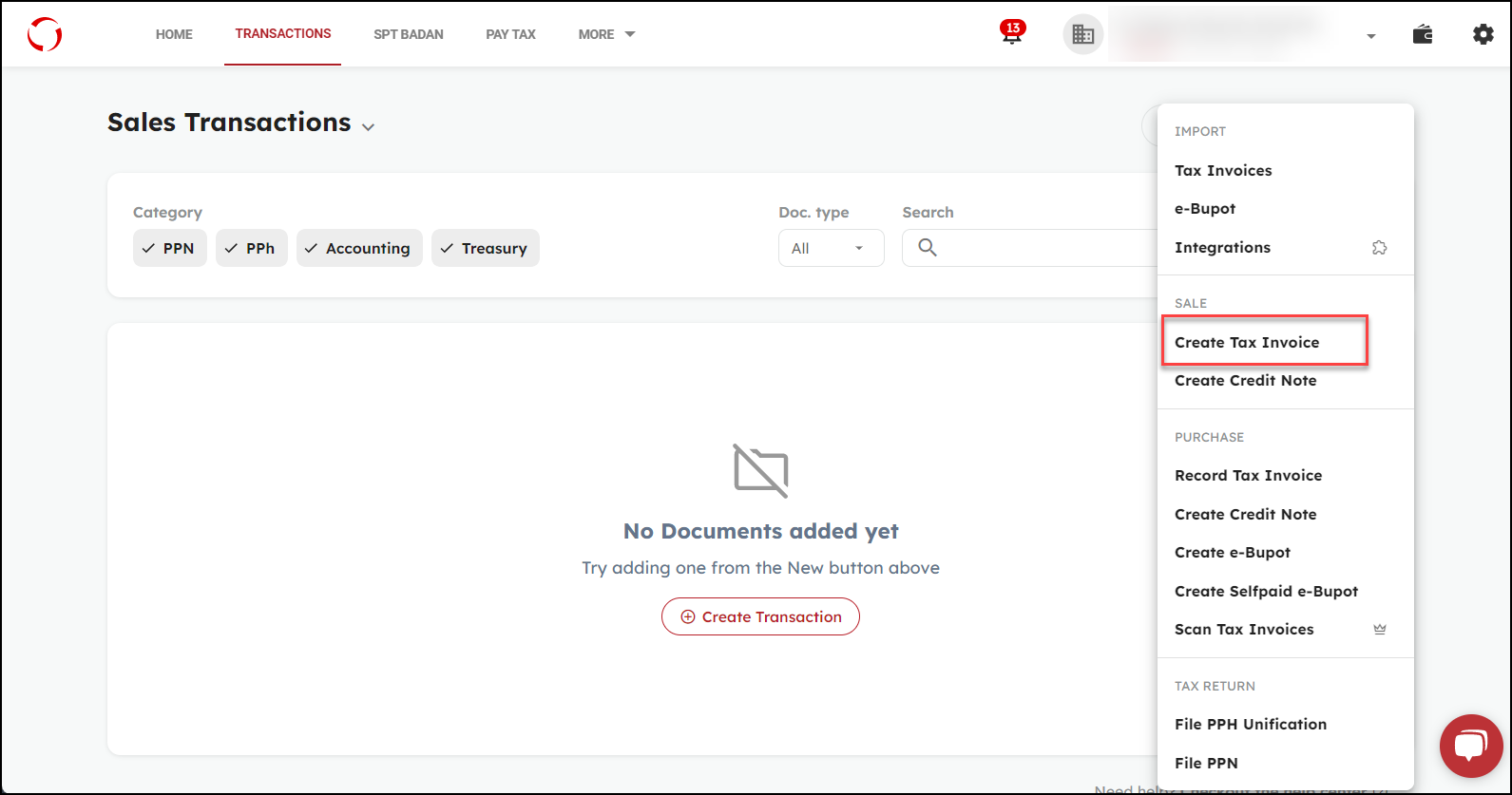

- Click the New button and select Create Tax Invoice.

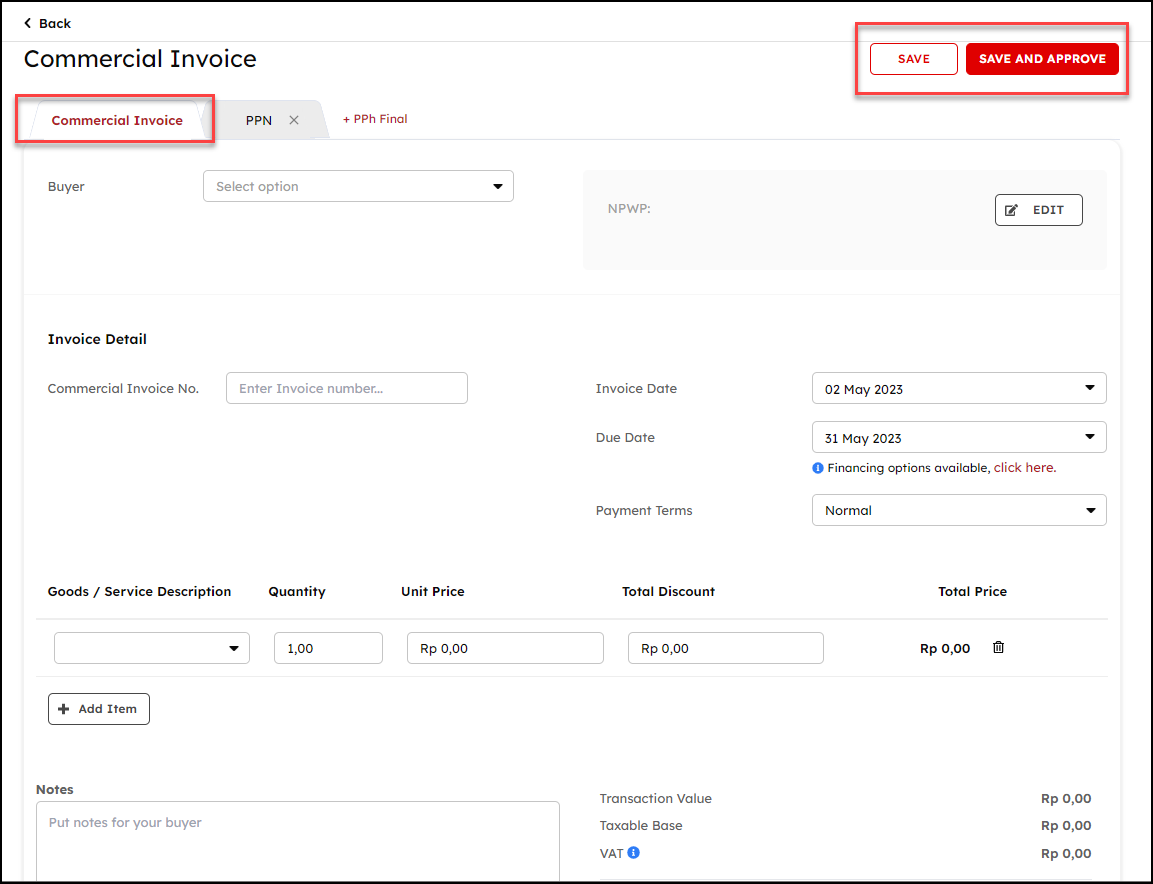

- On the Commercial Invoice tab, click on the Buyer column and fill in the buyer’s detail. If the buyer is a foreign party, tick the checkbox.

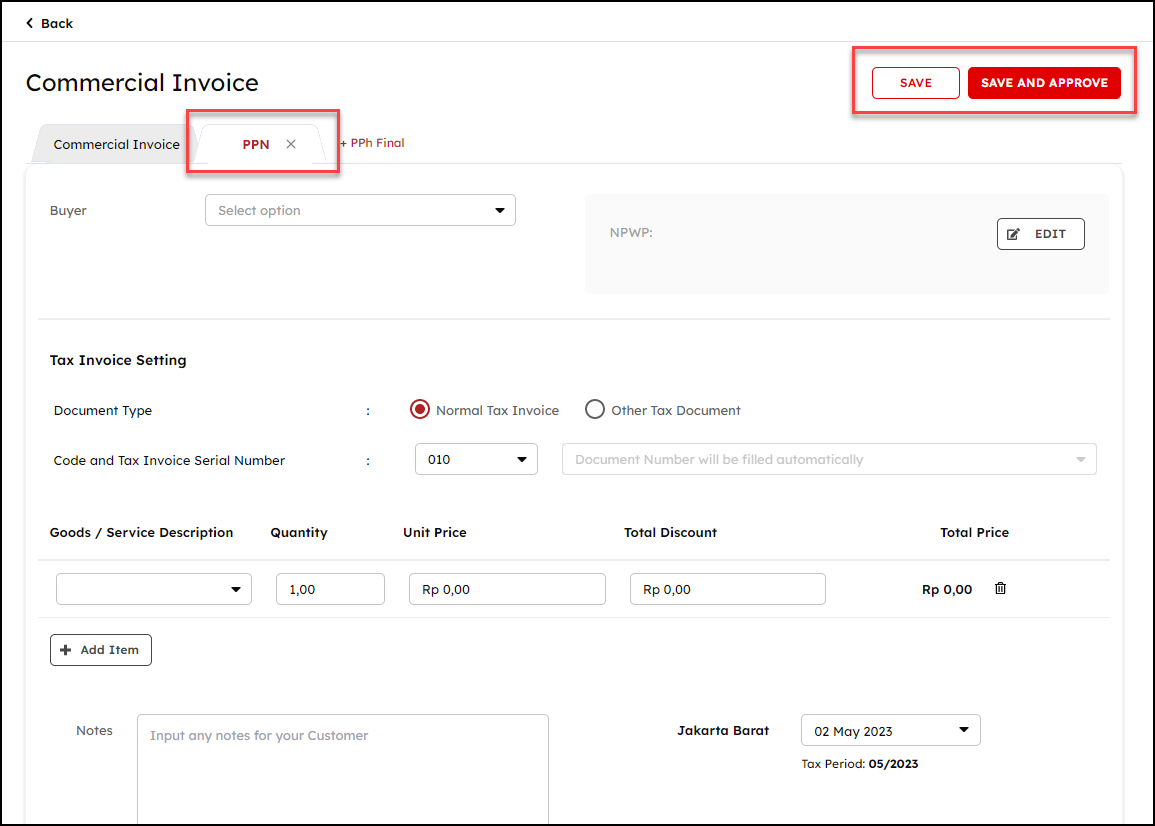

- On the VAT tab, select and complete the required data, such as Document Type. The Tax Invoice Serial Number will be filled in automatically. and click Save and Approve.

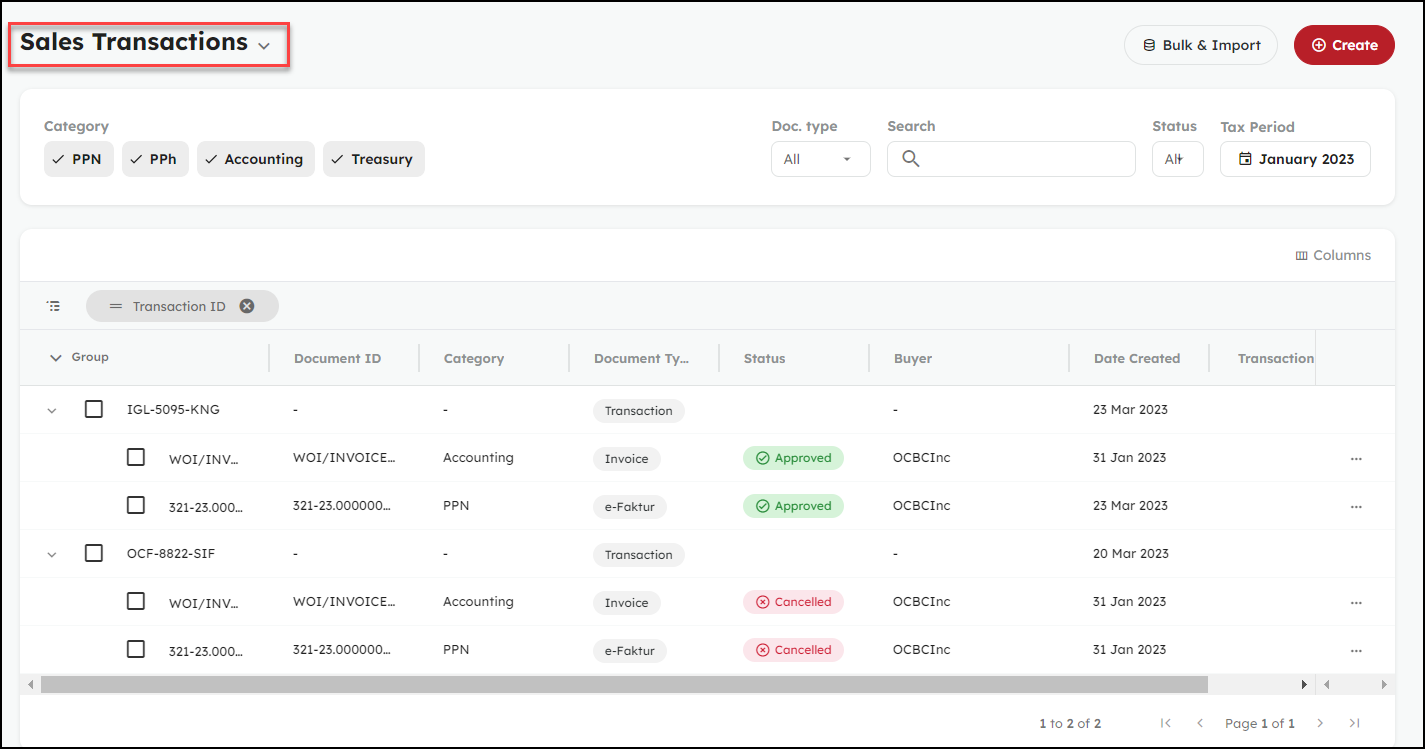

- You will see the Sales Tax Invoice that you have created along with the Commercial Invoice.

- Choose Tax Return if you want to report the tax