Here are the steps to create an e-Bupot Unification (Indonesian vendor) / e-Bupot Unification (foreign vendor) using the OnlinePajak application:

-

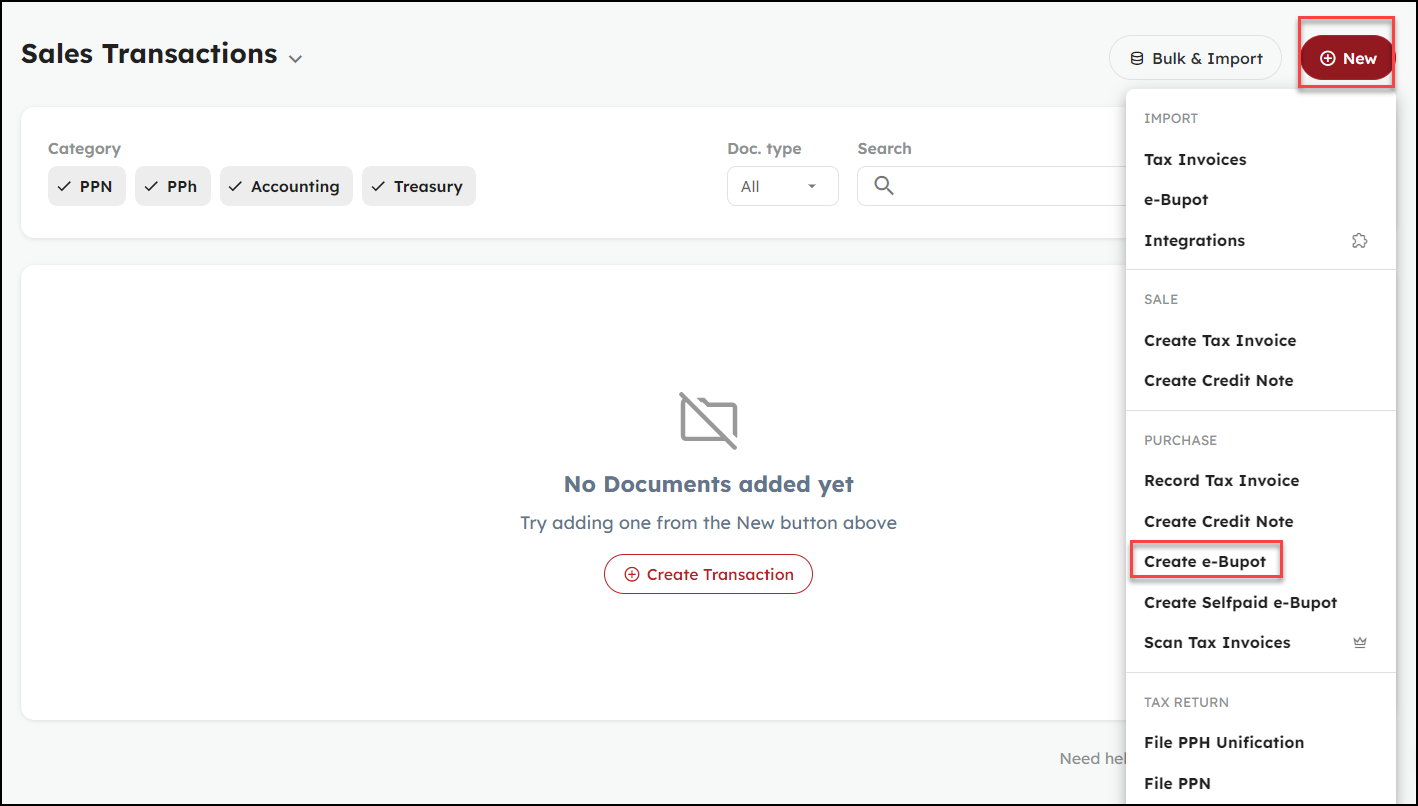

Log in to your OnlinePajak account. Click on the Transactions menu, then click on the +New button and select the Create e-Bupot option.

-

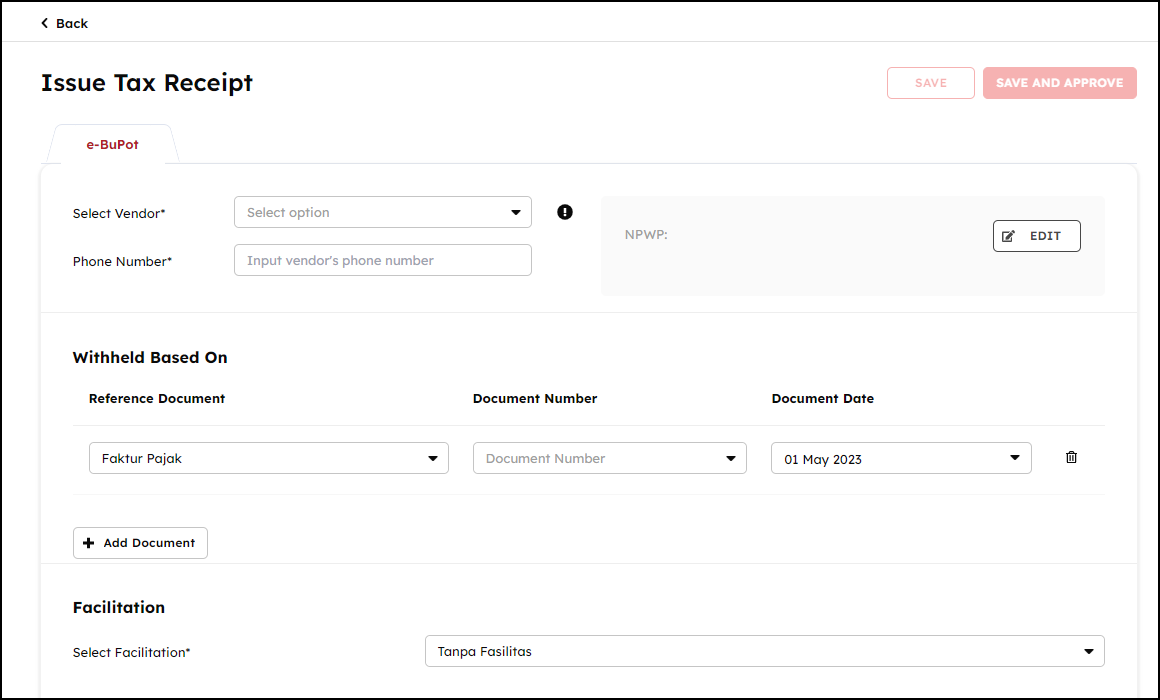

Complete the Identity Data of the Counterparty, you can use the NPWP or ID Card number for domestic taxpayers and TIN (Tax Identification Number) for foreign taxpayers.

-

Complete the reference document that becomes the Basis of Deduction.

-

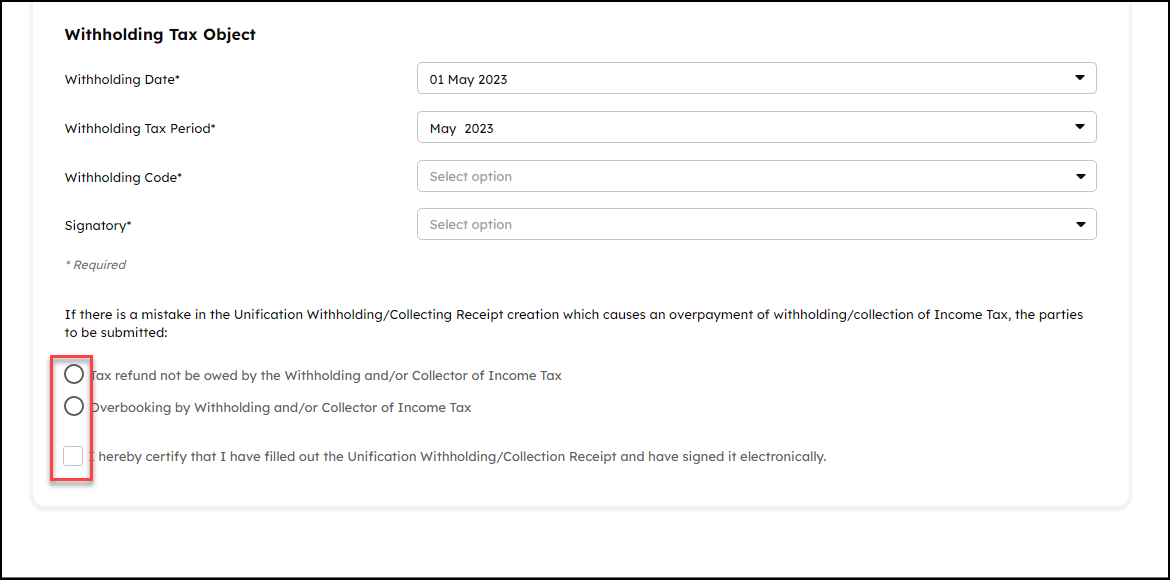

Next, complete the Tax Facilities and Object section. If the counterparty does not have supporting facilities (such as a Free Letter of Recommendation or a facility borne by the Government), please select “without facilities” and complete the Object of Tax (make sure the details you fill in are in accordance with the transaction stated in the reference document), then click the Save button.

-

The Bukti Potong that you have created will have a status of “Approved”.